In a welcome trend for prospective homeowners, mortgage rates are on a downward trajectory, reaching their lowest point in 10 weeks. This decline has sparked a surge in demand for purchase loans, marking the fourth consecutive week of growth, according to the Mortgage Bankers Association (MBA).

The MBA’s weekly survey of lenders reveals a noteworthy 5 percent increase in purchase loan applications last week, demonstrating a clear positive momentum in the market. Despite remaining 19 percent below the levels seen a year ago, the steady rise over the past month is indicative of a resilient and optimistic homebuyer sentiment.

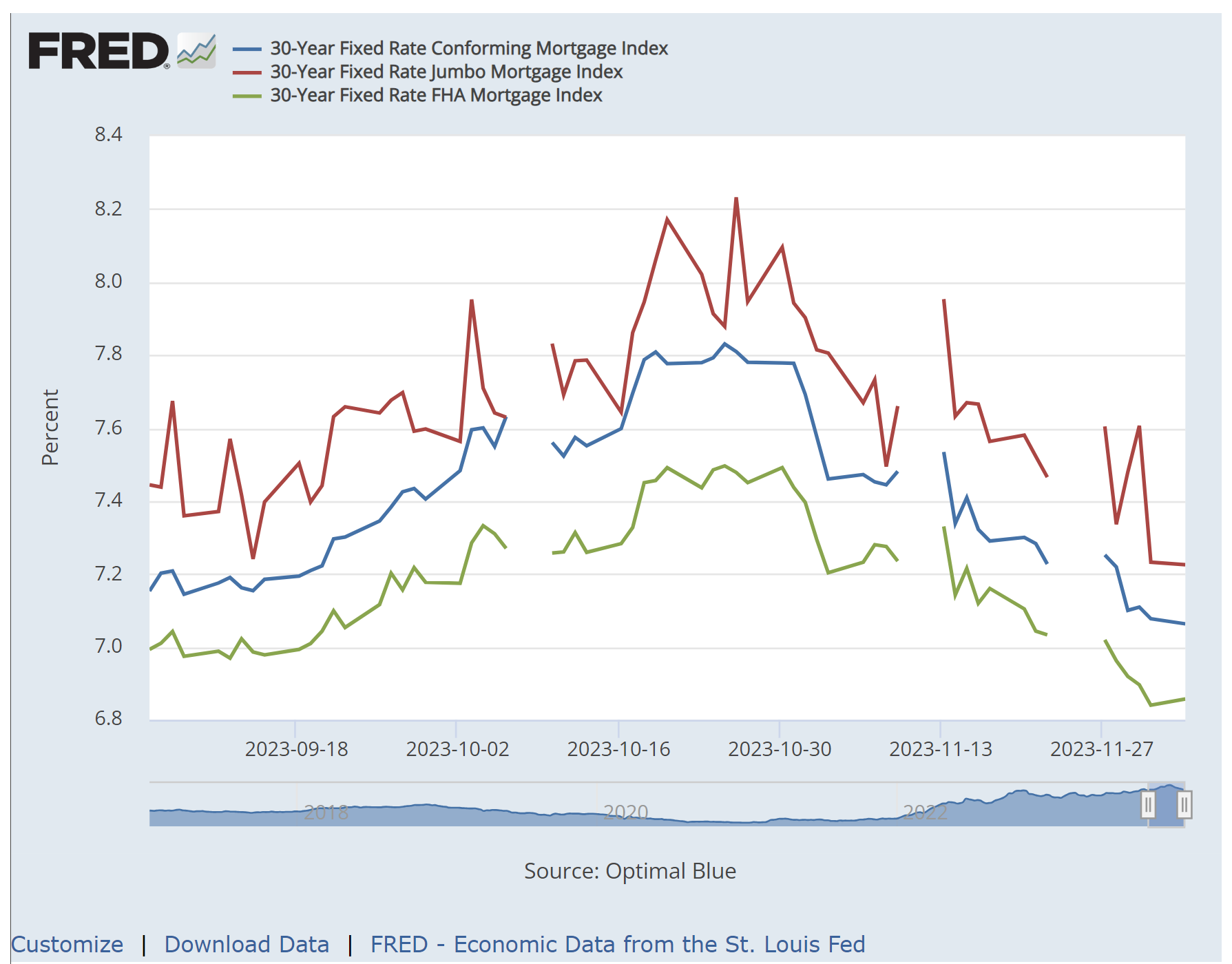

The recent data highlights a robust response from buyers who are capitalizing on the favorable conditions. Mortgage rates, tracked by Optimal Blue, show a substantial 73 basis-point drop from their 2023 peak on October 25, with 30-year fixed-rate mortgages now averaging 7.10 percent – the lowest since September 1. Even FHA loans have witnessed a significant decrease, falling to 6.92 percent.

What’s driving this positive shift? Bond market investors, key players in mortgage funding, are growing increasingly confident in the Federal Reserve’s ability to control inflation. The possibility of the Fed not just halting rate hikes but potentially reversing course and lowering rates in the spring has created a ripple effect in the bond market.

Recent remarks by Federal Reserve Governor Christopher Waller, a known inflation hawk, further bolstered investor confidence. Waller acknowledged signs of easing inflation and hinted at the Fed’s openness to rate cuts if this trend continues. This stance has resonated positively in the bond market, with investors showing optimism about the future trajectory of interest rates.

Economists are divided on the speed at which mortgage rates will continue to decrease. While some foresee a “higher for longer” rate strategy, others project a more rapid decline. Notably, the Mortgage Bankers Association anticipates rates falling to the mid-6 percent range by the end of next year and dropping into the mid-fives by the end of 2025.

The current scenario presents an opportune moment for homebuyers to act. However, challenges persist in the form of a low supply of existing homes on the market, which has kept the purchase market somewhat subdued. Nevertheless, with mortgage rates becoming increasingly favorable, there’s a positive outlook for both buyers and the housing market as a whole.

As we navigate these exciting developments, if you’re considering making a move into homeownership, now is the time to seize the opportunity. For personalized guidance and to explore the best mortgage options tailored to your needs, call us today. Let’s turn your homeownership dreams into reality!

Contact us today at 210-418-0067 to discuss your homebuying journey and secure the best mortgage rates available. Our team is ready to guide you through every step of the process!