Get ready for some crucial insights into the 2024 housing market. Here’s a breakdown of what to expect:

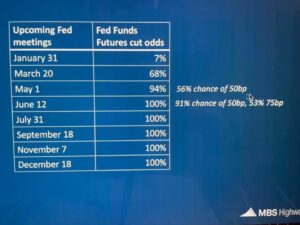

- **Fed Meetings & Rate Cuts:** Odds are favoring a rate cut on May 1st, but I’m betting on March 20th! Why? Inflation is likely to dip below 3%. This move will significantly influence the pace of interest rate declines. 📉

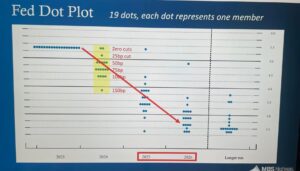

- **Fed Dot Plot Analysis:** Check out the Dot Plot! It’s fascinating – 19 Fed members predicting rate cuts. Most see a 50-75 bps cut soon, and we’re all for the 75 bps. Looking ahead to 2025-26, expect major cuts, possibly leading to rates around 4%. But, be cautious with refinancing in 2024 – it might be too early, and the costs could outweigh the benefits. Need advice? Consult a financial advisor or a trusted expert to crunch the numbers for you. 📊

- **Affordability Reality Check:** Media headlines scream an 80% hike in housing payments, but let’s look deeper. It’s more of a 20% increase in required income to cover the higher payments. Wages have risen 15% since 2021, so the actual affordability gap is just 5%. Knowledge is power! 🏡💸

- **2024 Forecast:** Expect steady but conservative growth. Home values should appreciate by 4.5-5%, thanks to ongoing demand and limited supply. Interest rates are likely to hover between mid-5% to low-6%, and transaction volumes could surge by 15-20%. Remember, rates don’t define success; our ability to adapt and inform does! 📈

Let’s navigate these changing markets together! If you’ve got questions or need personalized advice, drop me a message. Let’s make 2024 a year of informed decisions and successful investments!

#HousingMarket2024 #RealEstateInsights #FinancialWisdom #InvestSmart